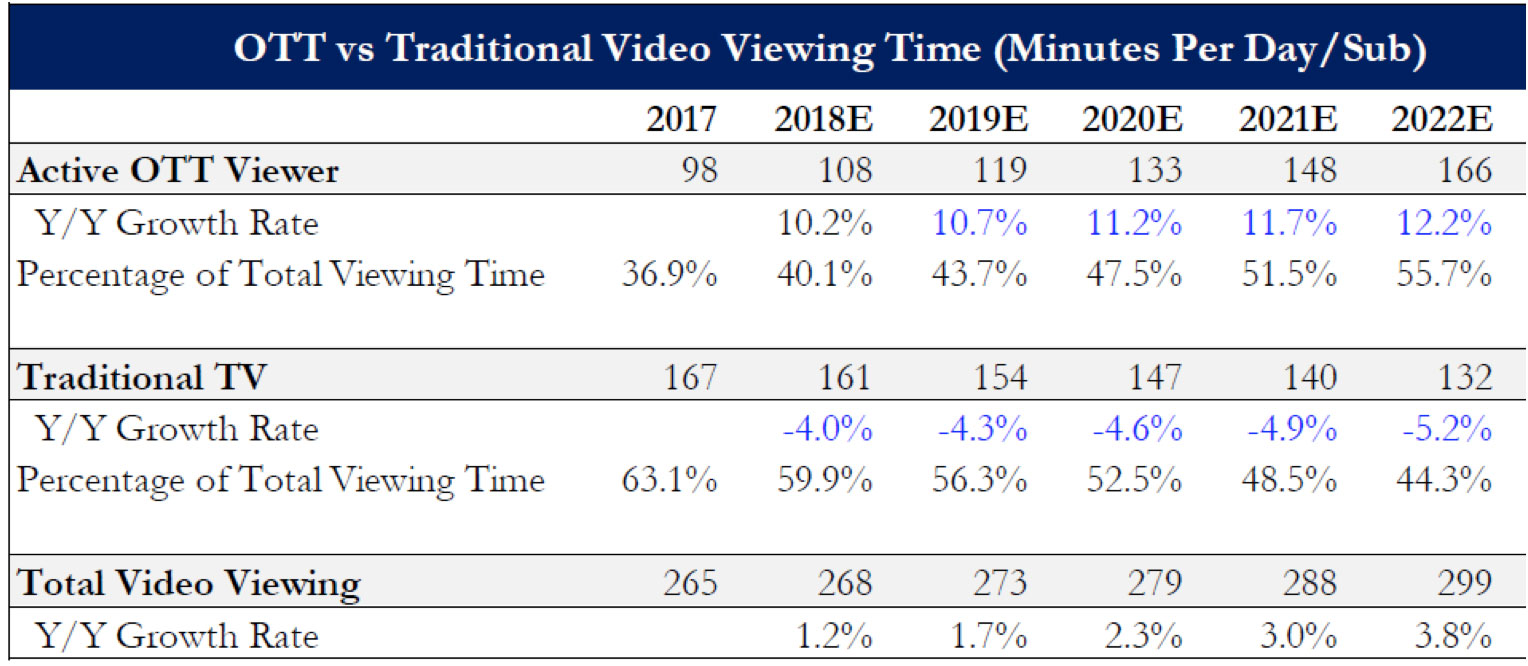

In the US, dramatic increases in bandwidth and high penetration of internet have given rise to disruptive new internet video services that are less expensive and superior to paid television. Consumer TV viewing habits as a result are shifting eyeball time away from legacy broadcast/advertising based television to multiple new entertainment services delivered over the internet (Over the top or OTT), and multiplayer online gaming. Though total video viewing time is expected to increase, traditional TV viewing time is starting to show a pronounced secular decline, while OTT viewing time is showing and projected to have accelerating growth (as measured by minutes per day/sub). This is shown in this table (Exhibit 1) below:

Exhibit 1: OTT v Traditional Video Viewing Time

Source: Statista, Comscore

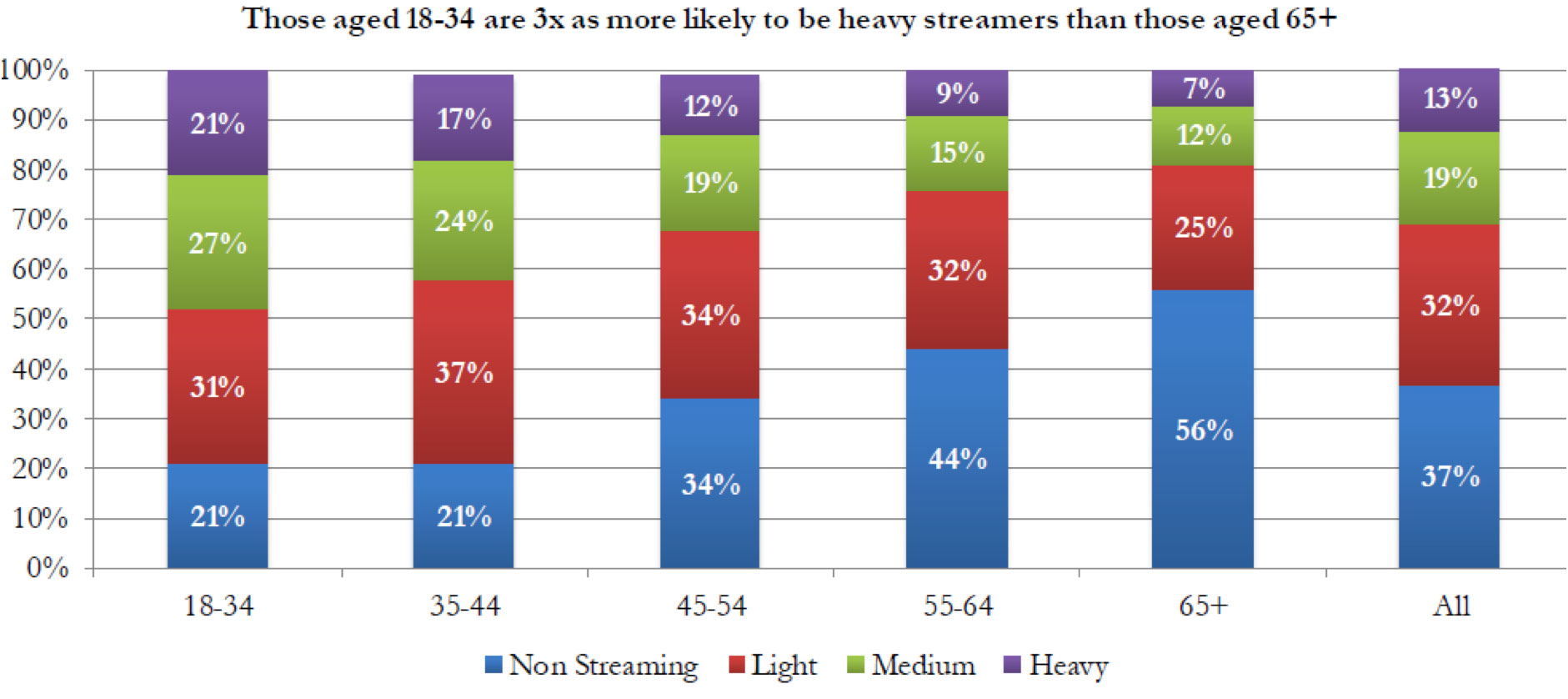

Demographics are playing an important role in the above trend – younger/millennial population have been surveyed to be more likely to be heavy users of OTT services than those aged 55 years and higher. Higher percentages of people aged 44 and under are seen as medium and heavy video streamers than the entire population set; this indicates a trend that will be secular in nature as this younger generation will determine future video viewing habits. (Exhibit 2)

Exhibit 2: Distribution of Video Streamers by Head of Household Age

Source: Comscore

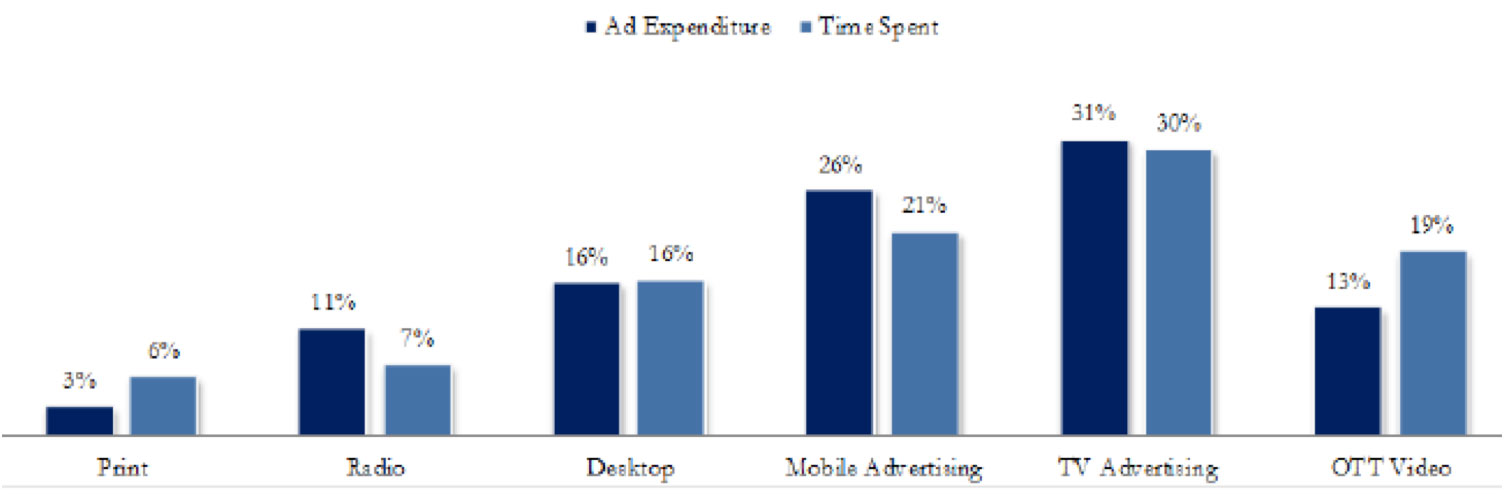

This ongoing paradigm shift in TV viewing habits will serve as a major catalyst for shifts in advertisement budgets from linear television to OTT video over the next several years as advertisers chase eyeballs. The table below shows that OTT video has a lower percentage of advertising spend, yet has higher percentage of time spent by consumers.

Exhibit 3: % Total Advertising Expenditure vs. % of Total Time Spent per Day on Media

Source: IAB internet advertising revenue report

In the long term, advertising budgets will tend to align with the time spent. Additionally, supported by Exhibit 1, with OTT viewership continuing to see steady growth, advertising spend on OTT platforms will see a much faster growth rate over the next several years. This will give rise to several investment opportunities over the next 3-5 years as budgets move from traditional linear advertising to new internet enabled OTT platforms.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of September 2018 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since September 2018 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team