The insurance industry, with its cycles of rising and falling pricing (known as hard or soft markets) can offer periods of meaningful earnings growth that can make it of interest to any investor looking for inflections in business trends. Insurance companies can operate in two types of markets, the admitted (or standard) market and the excess and surplus (E&S) market. Insurance carriers operating in standard lines have policy terms closely regulated by state insurance departments. E&S carriers operate in the part of the insurance market that has more flexibility with pricing and terms and conditions.

Over the last few years, there has been a hard E&S market and we have successfully invested in companies generating meaningful growth facilitated by the cyclical upturn. More recently, admitted insurance, particularly personal lines (mostly homeowners and auto insurance), has reached a profitability inflection point after a long stretch of losses is coming to an end driven by premium rate increases accelerating and cost inflation decelerating.

While many types of insurers were impacted by COVID and inflation, auto insurance carriers were particularly hard hit as used car prices rose, the cost to repair vehicles increased, labor and parts shortages increased the time it took for repairs to be completed and car rental rates spiked. On the revenue side, regulators required many auto carriers to provide rebates to their policyholders during lockdowns and were subsequently very slow to allow carriers to pass through rate increases to offset inflationary cost pressures. The result was a significant deterioration in profitability for personal lines insurers from 2021 through 2023.

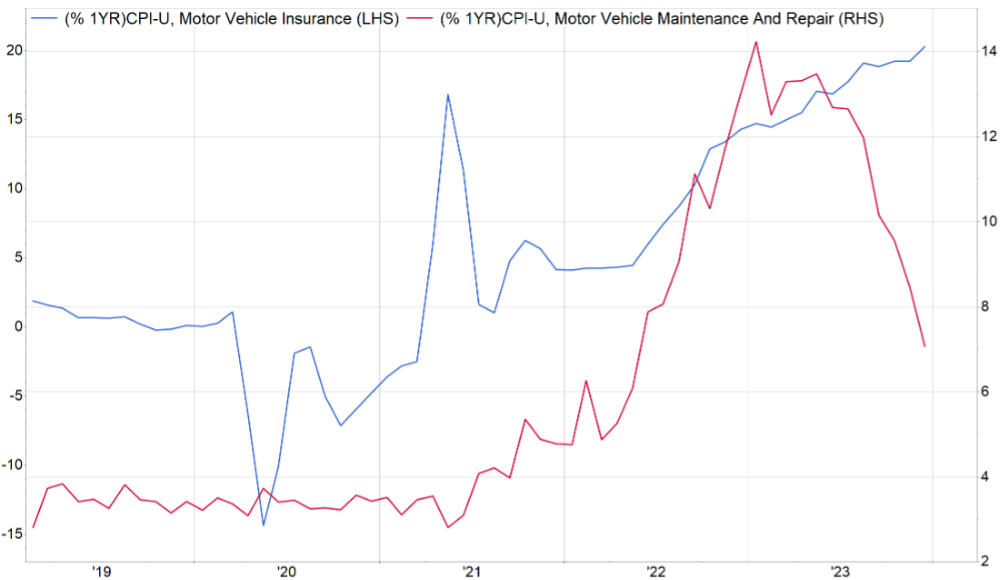

Encouragingly, in 2023 regulators in key states such as California and New York started to approve larger than normal rate increases to allow auto insurers to offset rising costs and discourage carriers from potentially exiting their states. At the same time, as 2023 progressed inflationary cost pressures peaked and began to recede. Exhibit 1 shows year-over-year rate increases as measured by the monthly Consumer Price Index accelerated to over 20% in December 2023 while the rate of increase in the cost of repairing vehicles meaningfully decelerated.

Exhibit 1: Motor Vehicle Insurance versus Maintenance and Repair

Source: FactSet Research Systems

As the spread between the lines in the chart widens, profitability for auto insurers should accelerate. Similar dynamics are at work in the homeowner’s insurance market, especially in Florida where reforms have been implemented to reduce the cost of fraud and litigation. Insurance carriers are not going to be the only beneficiaries of the hard market in personal lines, with some brokers seeing improved profitability as commissions increase due to higher pricing and better profitability, while companies operating in the advertising and customer acquisition ecosystem benefit from carriers returning to normal levels of advertising spending after pulling back to offset losses. While the duration of this hard market is difficult to forecast, the near-term prospects for industry participants is promising.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of February 2024 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since February 2024 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team