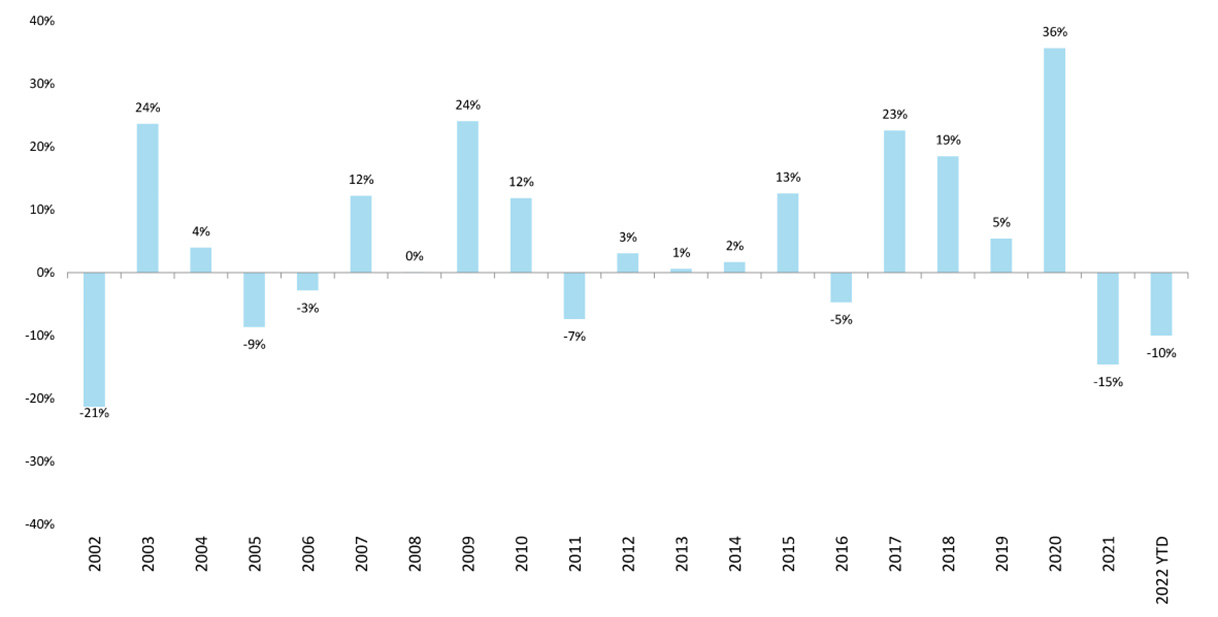

The software sub-sector was amongst the biggest beneficiaries during COVID in 2020 as enterprises and small businesses accelerated digital transformation projects by adopting software to transform their businesses. This resulted in the software sub-sector seeing highest outperformance in two decades versus the SPX in 2020. However, since early 2021, the sub-sector has seen significant underperformance as macro concerns around inflation and higher interest rates have negatively impacted asset valuations.

Exhibit 1: Software Performance (Represented by IGV, Software ETF) Relative to SPX

Source: Jefferies

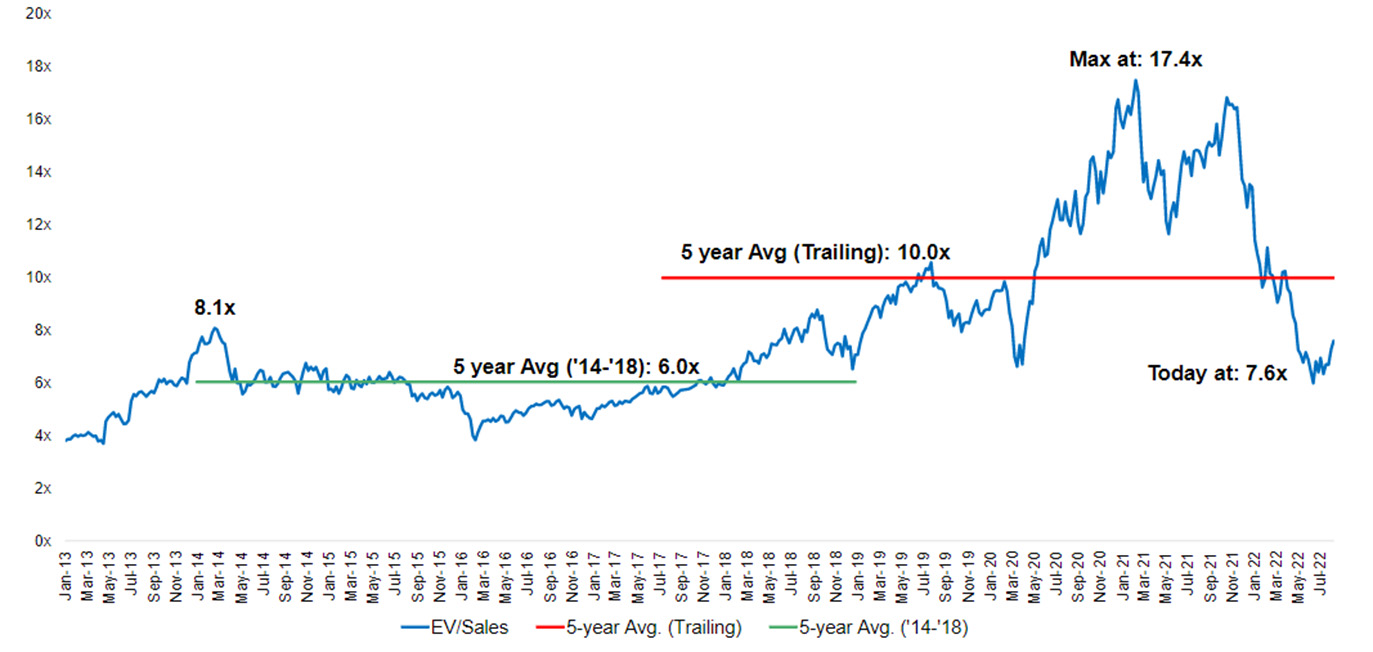

Software valuation has been on a roller coaster ride with 2020 seeing multiple expansion off robust spending conditions and a complete reversal of multiples over the last 12 months driven by macro concerns around inflation and higher interest rates, with recent multiples reverting back to levels seen at COVID lows in March 2020 (Exhibit 2)

Exhibit 2: Enterprise Value/Next Twelve Months (EV/NTM) Sales (Total Software Group ex. New Additions)

Source: Morgan Stanley

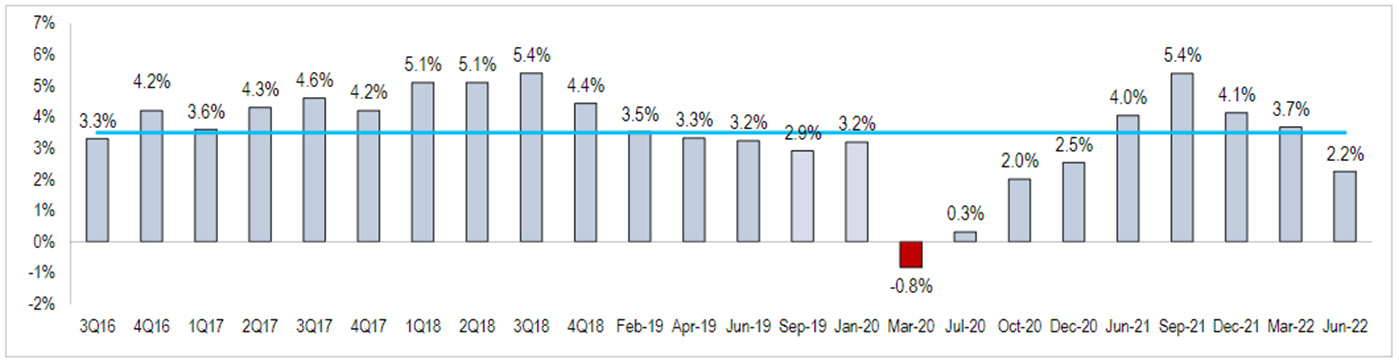

Valuations compressing to COVID lows at a time when inflation is seen peaking by leading macro economists provides valuation support for the group. However, CIO surveys are showing mixed datapoints with sharp deceleration expected in IT budget growth over the next 12 months (Exhibit 3).

Exhibit 3: Global IT Budget Growth

Source: Citi

As we look at our positioning in the software sub-sector, we see two equally dueling forces to take in to account. Multiples reversing to COVID lows have removed froth in valuation. However, further weakening of IT budgets can result in risks to revenue estimates for 2H22 and 2023. Thus, we have a neutral stance on the sub-sector versus the Benchmark as we await better clarity on both interest rates/inflation and 2023 IT budget plans.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of August 2022 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since August 2022 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team