The Romanian economy is somewhat unique among frontier and emerging markets and is benefiting from a set of conditions different from its peers. We believe the combination of a strong cyclical recovery, an ongoing structural reform push, and a growing role in the regional energy landscape make Romania an attractive investment destination.

To summarize 10 years of Romanian economic history into a few sentences, the country experienced a robust credit boom and painful bust following the 2008 global financial crisis. Despite being a relatively underleveraged economy, the bust killed the banking sector and the pain is only now alleviating. With nonperforming loans declining and recovery rates on the rise, the banks’ capital positions can again support the rising demand for consumer finance. The turnaround is already visible in the progress of loan volumes, which are turning positive for the first time in several years. This evolving dynamic suggests that Romania will be the fastest growing European economy next year with 3.9% GDP growth year over year, according to IMF estimates (Exhibit 1). And with public debt-to-GDP under 40%, Romania is also one of Europe’s healthiest economies (Exhibit 2).

Exhibit 1: After a painful deleveraging, Romanian growth (blue, shaded) is again starting to outpace the region (yellow)

Source: Bloomberg

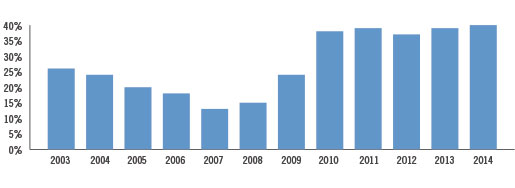

Exhibit 2: Romanian debt to GDP

Source: Bloomberg

The ongoing recovery has been consumer-led with real wages rising and taxes having been cut meaningfully. Within the financial sector, the key risk to companies’ earnings is a further decline in interest rates in Romania. Given the strength of the consumer recovery and the limited spare capacity on the supply side, a consumer recovery cannot come without inflation. Thus, the central bank is not likely to lower rates next year.

Government spending, however, has been conspicuously absent. The country has ample fiscal space to take on additional spending but its recent corruption crackdown has reached the highest levels and government employees are scared to sign any contracts. As a result, public spending, specifically public infrastructure spending, has ground to a halt. The early-November fall of the prime minister to corruption charges has not helped matters.

Remarkably, despite desperately lacking adequate infrastructure, Romania is leaving EU accession funds on the table by failing to spend enough. Equally important, however, is what this corruption crackdown means for the future of Romania. Corruption has become intolerable at the government level and nobody is safe. For a country that has had such a problem with corruption in the past, and has such an ambitious structural reform agenda going forward, this is an unequivocal positive.

While lacking the demographics of some of south Asian investment destinations, the low-hanging fruit for Romania to improve productivity is something we have not seen elsewhere. To illustrate that, consider that the country’s main export destination for its industrial goods is continental Europe. The country is, however, not even linked to Europe by highway even though the EU would repay Romania for the road should the government disburse the funds required to build it. Labor is extremely cheap relative to the rest of Europe and labor productivity is unnaturally low given the high concentration of agricultural workers on small-plot farms. Education levels are also low relative to those in Europe but are improving quickly.

Going forward, there is additional low-hanging fruit to be harvested through the execution of fairly straightforward capital markets improvements as well as strategic investments in the country’s energy infrastructure. While it is entirely possible that recent political turbulence will delay these initiatives, the likelihood that they will be completed remains high.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of December 2015 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since December 2015 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Small Cap Equity Strategy March 2024 Commentary With Attribution

By Chad Cleaver, CFA

Driehaus Emerging Markets Growth Strategy March 2024 Commentary with Attribution

By Howie Schwab