Operating leverage is an investment theme within the Driehaus emerging market strategies that we have been increasingly focused on over the past year. The thought process is as follows: While emerging market corporates have historically been incentivized to invest aggressively to capture strong demand growth facilitated by economic tailwinds, their mentality has changed. Decelerating GDP growth in recent years has created a more challenging operating environment, which has forced management teams to shift focus toward cost efficiency measures and rationalization of investment. This has resulted in a reduction in the ratio of capital expenditure to sales.

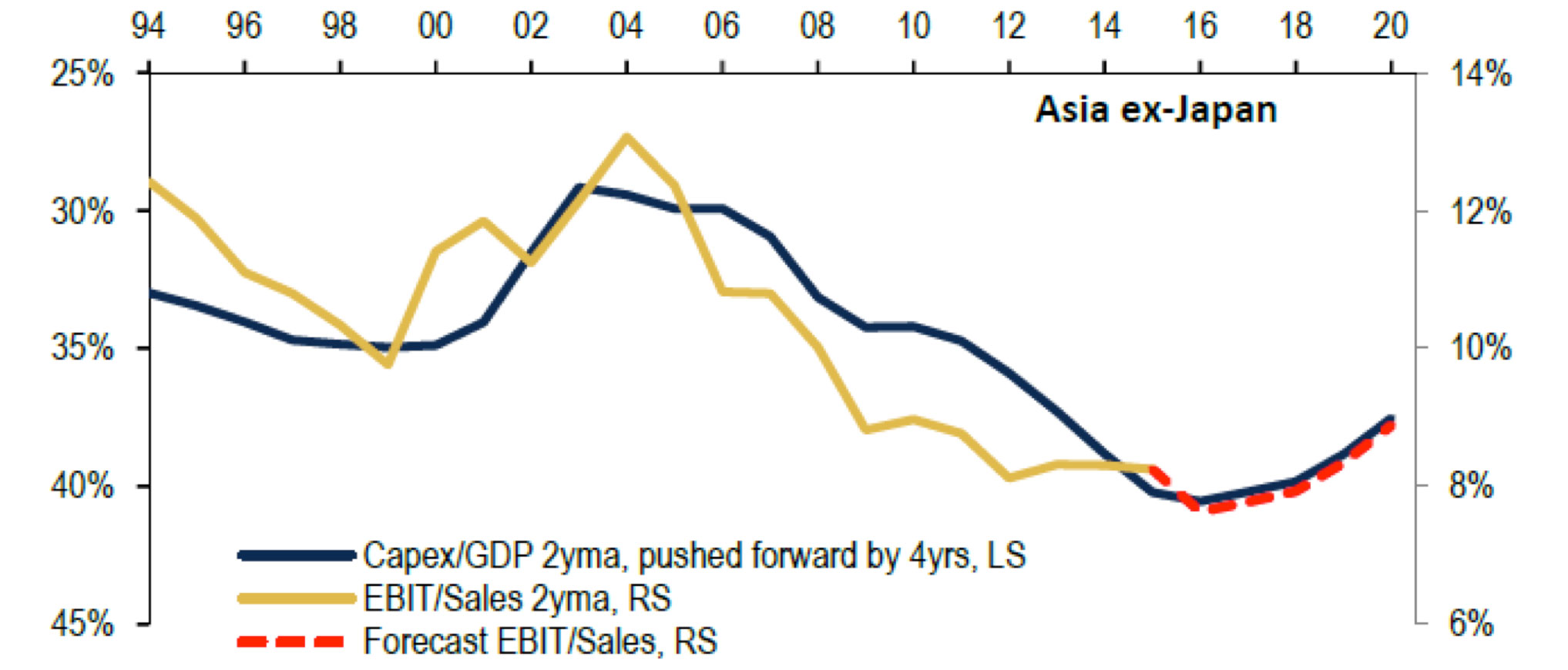

With emerging market GDP growth now stabilizing, and in many countries improving, the operating environment is beginning to brighten. Many emerging market companies are now operating on more efficient cost bases due to the rationalization efforts of recent years. This suggests that as revenue growth accelerates, fixed costs will be better spread across the sales base, and a larger percentage of each incremental dollar will be captured in earnings. Exhibit 1 illustrates this point nicely, as it shows that falling Capex/GDP tends to be a precursor to rising profit margins. The chart depicts emerging Asia, but we believe it is applicable to emerging markets in general.

Exhibit 1: Falling Asia ex-Japan’s Capex/GDP leads to improved EBIT margins

Note: Sales/Assest for MSCI Asia ex-Japan (ex-financials) universe Source: BofA Merrill Lynch Global Research

The Driehaus investment philosophy emphasizes the idea of positive inflection and identifying companies that are generate earnings growth acceleration. Inflection points can take a number of forms, and we see cost/investment rationalization (and subsequent realization of operating leverage) as an increasingly prevalent source.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of November 2016 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since November 2016 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Small Cap Equity Strategy March 2024 Commentary With Attribution

By Chad Cleaver, CFA

Driehaus Emerging Markets Growth Strategy March 2024 Commentary with Attribution

By Howie Schwab