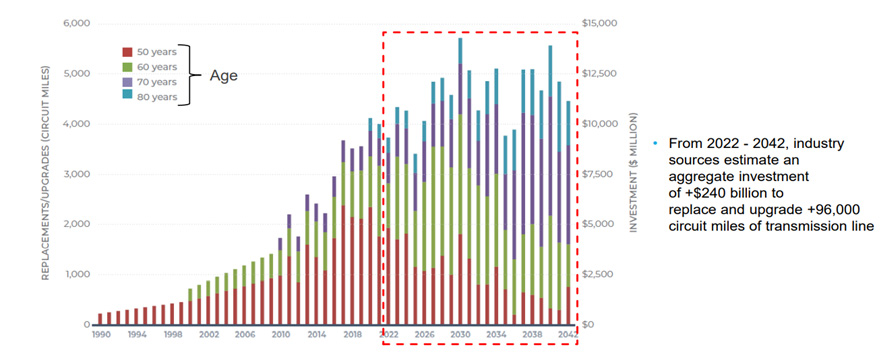

This week I attended an Industrial conference. It is evident companies are facing one of the more fluid and dynamic macro environments they have ever seen. Supply chains are improving at the margin, but they remain far from normalized. Inflation is still present, but it is showing signs of improvement. The positive rate change was encouraging to hear. Despite this challenging backdrop, there are industries that present clear and present opportunities. One area universally cited as a bright spot was power generation and infrastructure. The United States has no choice but to invest in this area or else we jeopardize the reliability of two of our most basic luxuries, climate control and electricity. There are an increasing number of examples of our grid failing due to adverse weather and increasing demand for electricity. As it stands today, we are not prepared for future power demand. One executive I met with shared a couple eye-opening statistics. As it stands today, 90% of our transformers and 60% of our distribution lines are beyond their useful life. Exhibit 1 demonstrates the demand for upgrading transmission lines.

Exhibit 1: Looking at the Grid ($ in millions)

Source: Americans for a Clean Energy Grid, "Planning for the Future", Jan 2021

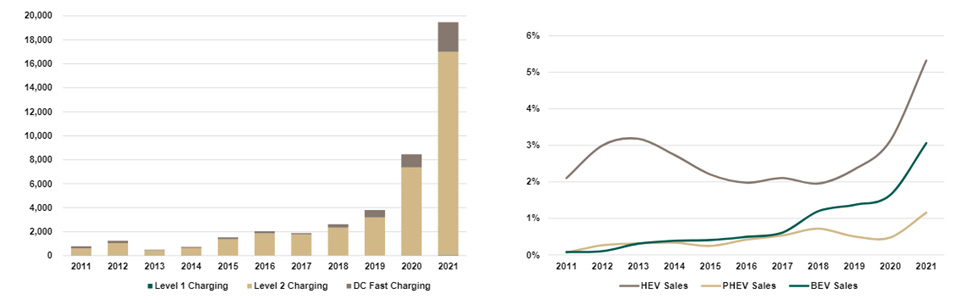

It is going to require several trillion dollars of investments to properly upgrade, modernize, and transition our grid to a more durable and renewable future. This represents several generations worth of demand, and it is against this backdrop we are investing in companies that will be utilized to build and replace our power infrastructure. Utilities are going to struggle to keep pace with demand from a more electric economy due to new technologies like the proliferation of electric transportation. Exhibit 2 demonstrates the inflecting investments in charging stations and EV penetration.

Exhibit 2: Number of Added Public Charging Locations in the U.S. (left) EV Annual Sales Out of Total US Vehicle Sales % (right)

Source: D.A. Davidson and Co.

Utilities’ capex budgets and contractor backlogs are accelerating, so the investment cycle is underway. Using expanding backlogs as a leading indicator, we have growing conviction in our exposed companies realizing significant earnings growth as these trends play out over the upcoming decade.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of September 2022 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since September 2022 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team