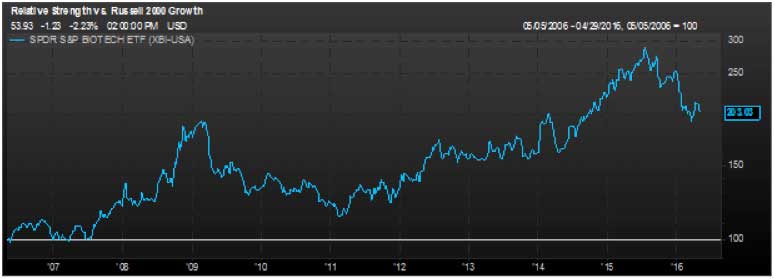

The biotechnology industry was a substantial outperformer between early 2011 and the middle of 2015, but since then has been a significant underperformer. Exhibit 1 shows a 10-year chart of the relative strength of the small cap-heavy S&P biotech ETF (XBI) relative to the Russell 2000 Growth Index.

Exhibit 1: Relative strength of the S&P Biotech ETF (XBI) relative to the Russell 2000 Growth Index

Source: FactSet, Driehaus Capital Management

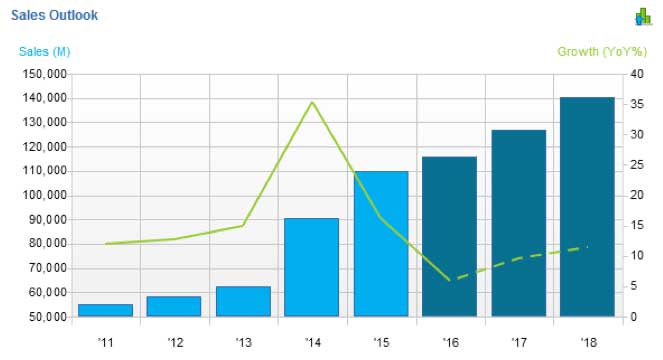

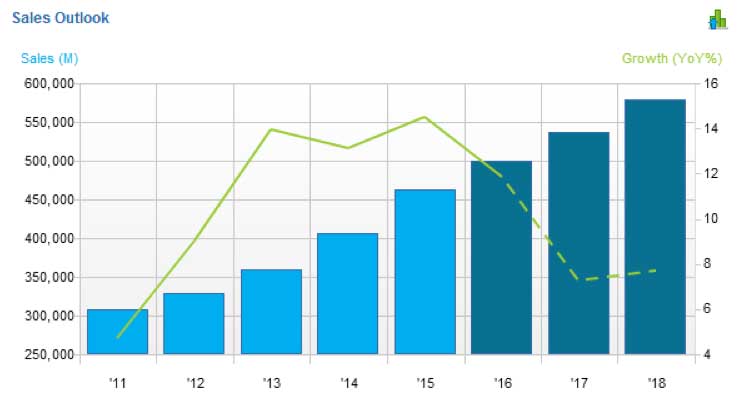

We’ve suggested many reasons for biotech’s outperformance over the years, including a positive regulatory environment, a positive pricing environment, and R&D engines that generated a generous amount of positive news. If we distill these positive tailwinds into one factor, it would be revenue growth. In Exhibit 2, we’ve plotted the biotech industry’s revenue and revenue growth going back to 2011. The industry’s growth began accelerating in 2011 and, on an annual basis, topped out in 2014. It has since continued to decelerate. The XBI’s underperformance during that period of revenue growth deceleration likely isn’t a coincidence.

Exhibit 2: Biotech industry revenue and revenue growth

Source: FactSet, Driehaus Capital Management

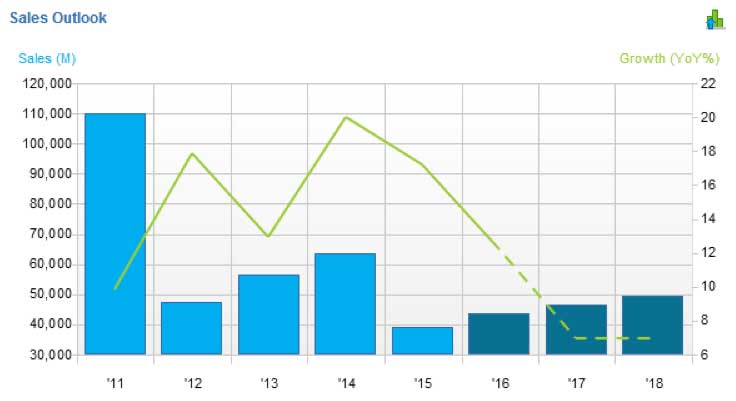

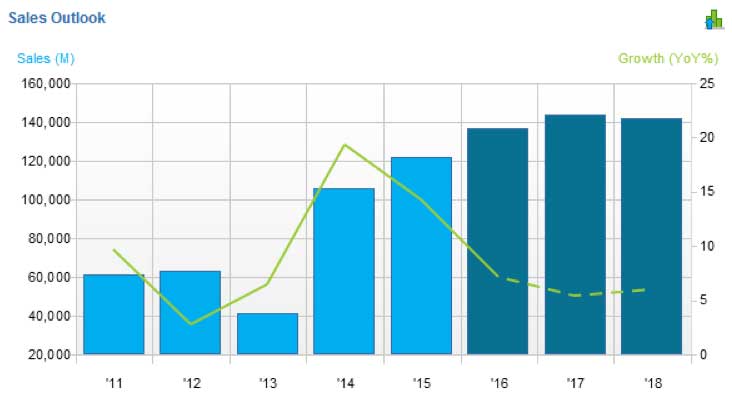

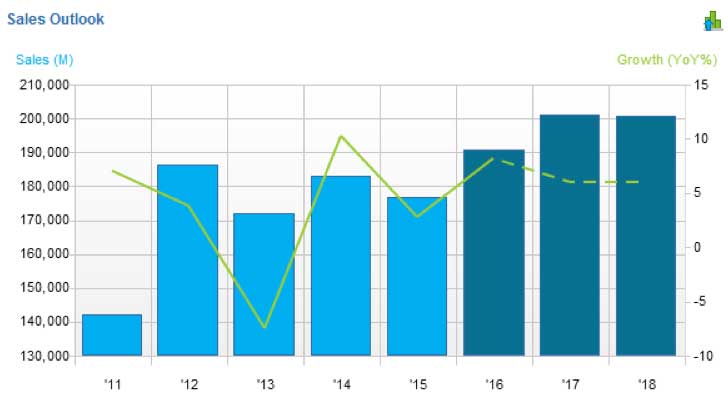

With biotech in the doldrums relative to years past, where in health care are there opportunities to find the same topline acceleration and, hopefully, the performance that we saw in biotech? In Exhibits 3-6, we provide charts of the other health care industries’ revenue and revenue growth, and there is one clear stand-out: medical technology.

Exhibit 3: Services to the health industry revenue and revenue growth*

*Includes health care IT, pharmacy benefit managers, care outsourcers, contract research organizations Source: FactSet, Driehaus Capital Management

Exhibit 4: Hospital & nursing management revenue and revenue growth

Source: FactSet, Driehaus Capital Management

Exhibit 5: Managed care revenue and revenue growth

Source: FactSet, Driehaus Capital Management

Exhibit 6: Medical technology industry revenue and revenue growth

Source: FactSet, Driehaus Capital Management

We are invested in many micro and small cap companies with new product cycles in the medical device industry. Outside of our market cap range, the large cap device companies have some significant new product cycles as well. These new product cycles, alongside several additional factors such as cyclical tailwinds, recent weakening of the US dollar, the medtech tax holiday, and subsiding pricing pressure, are likely key to the accelerating topline of the medical device industry.

The medical device industry is the single industry within health care that is seeing accelerating growth. This benefit should cause multiple expansion given that health care investors are likely to shift capital to the industries experiencing improving growth. With the many attractive, new-product cycles underway and the limited sources for strong, sustainable growth in health care, we believe the medical device industry should outperform other industries within this sector.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of May 2016 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since May 2016 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team