The market has been obsessing over the long and variable lags of monetary policy; the tacit implication being that economic growth, especially in Emerging Markets (EM), must suffer deeply from tightening. Standard economics and many of the models and heuristics observed by market participants pointed in that direction (e.g., the Phillips Curve, yield curve inversion, and the Sahm rule) but we have not been in a standard economic environment. To be sure, we recently lived through one of the largest coordinated hiking cycles in monetary policy history (in fact, the steepest in modern US history), and yet, the domestic consumer and EM economies are still standing. While a fair bit of attention has been given to the surprising resilience of the domestic economy/consumer and the many contributing factors (i.e., excess savings, mortgage refinancings, labor market strength, etc.), the resilience of EM economies is all too often overlooked or underappreciated. In fact, the stories are similar in several important ways.

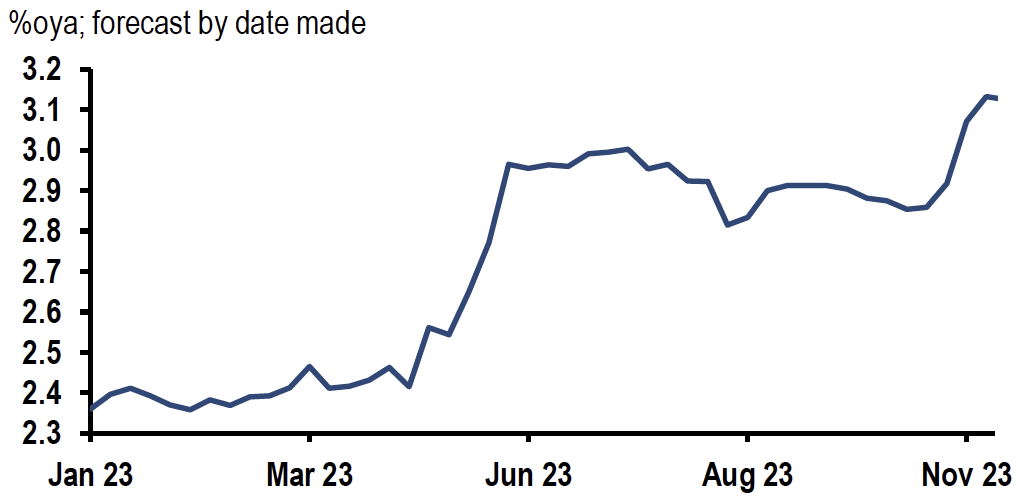

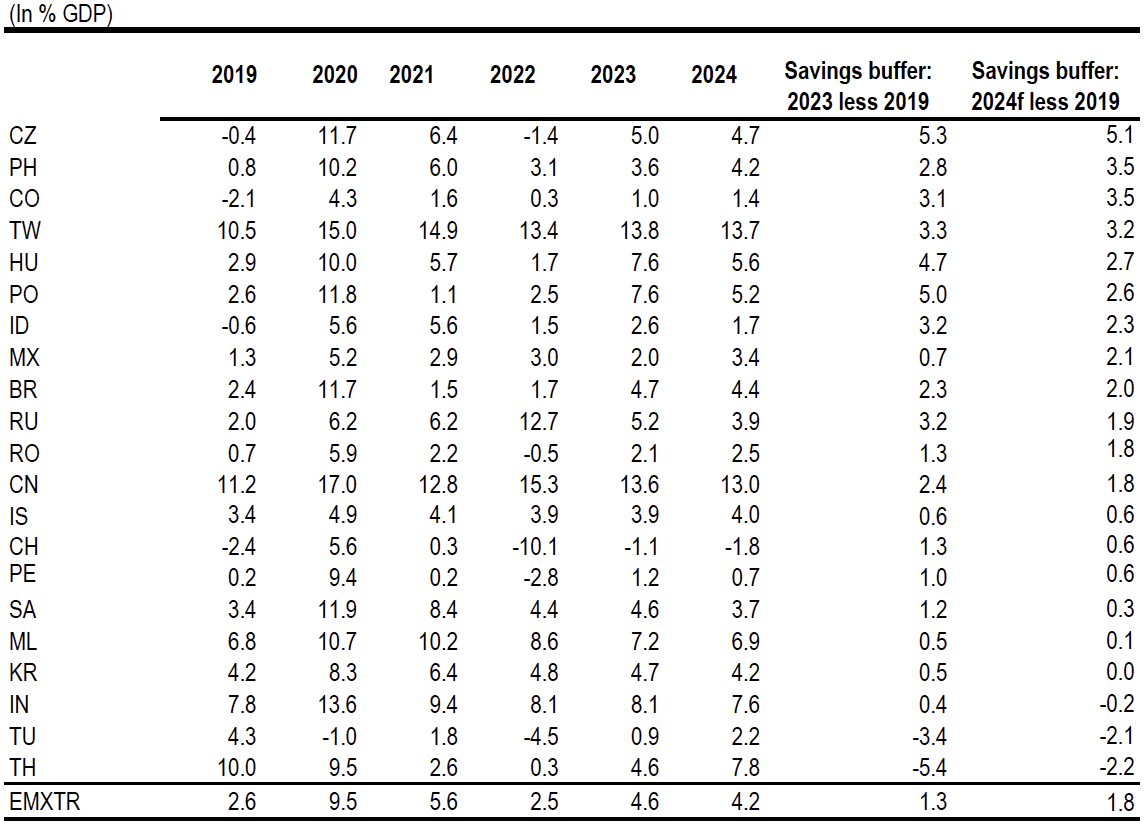

In much the same way that the domestic consumer was shielded by excess savings, EM economies benefitted from a combination of relatively low debt and high savings in the private sector. There was also an analog to this on the sovereign level that benefitted EM. Instead of collapsing under the pressure of increasing cost of capital and debt service as many had either feared or predicted, economic growth often surprised on the positive side in EM this year. Indeed, JPM’s forecast for 2023 EMX GDP growth (EM excluding China, Russia, and Turkey) was steadily revised upwards throughout the year. Importantly, much of the positive economic surprise came from domestic demand strength in EM. The good news for EM is that the savings buffer that was a critical component to this year’s resilience is unlikely to disappear. JPM estimates actually show an increase in this measure next year.

Evolution of EMX* 2023 GDP Growth Forecast

Source: J.P. Morgan. *Excludes China, Russia, and Turkey

Emerging Markets Private S-I Balance

Source: J.P. Morgan. CE-4 balanced adjusted for EU grants.

We have come a long way since the hiking cycle first started (recall that Brazil and Russia were among the first central banks to hike) and there were concerns we might see a rehash of the dynamic that gave rise to the “Fragile Five” moniker back in 2013. At this time last year, the market was staring down the specter of a massive hiking cycle. Now, the market thinks we have seen the peak of policy rates and many EM central banks have already begun easing cycles. This should be further good news for EM.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of January 2024 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since January 2024 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Small Cap Equity Strategy March 2024 Commentary With Attribution

By Chad Cleaver, CFA

Driehaus Emerging Markets Growth Strategy March 2024 Commentary with Attribution

By Howie Schwab