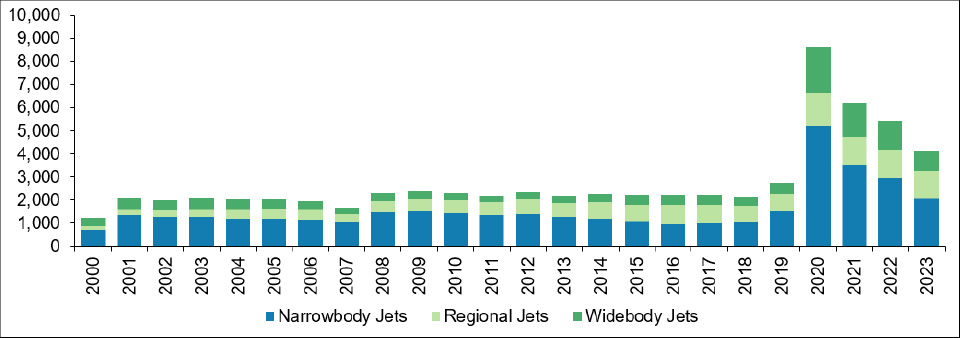

As a result of the impact from COVID, air traffic fell nearly 60% in 2020, but has now recovered a significant amount of that downturn. As of March 2023, total revenue passenger kilometers (RPK) traveled, as reported by the International Air Transport Association (IATA), were 12% below 2019 levels while domestic RPK’s are only down 1.1% from 2019. In response to this normalizing of air travel demand, along with a desire to modernize fleets, airlines are placing new purchase orders and returning parked aircraft to the active fleet. The combined backlog of Boeing and Airbus is now over 12,000 aircraft with delivery slots sold-out for the 737 and 787 through 2026 and the A320 through 2028. Additionally, parked aircraft, shown in Exhibit 1, are estimated by Jefferies to be around 16% of the current fleet which is down over 50% from levels in April 2020.

Exhibit 1: Aircraft in Storage

Source: Morgan Stanley

While this seems like a strong demand scenario, trends have been bumpy due to supply chain issues. Shortages of various components, along with elevated labor attrition resulting in a less experienced labor base, have constrained the ability of original equipment manufacturers (OEM) to produce aircraft. These delays in the supply chain will likely cause older aircraft to be used in service for longer periods and parked aircraft to continue to be used for spare parts. Commentary from some aerospace suppliers indicate airlines are continuing to burn through engine “green time” at elevated rates. Eventually the supply chain will catch up and the pace of new aircraft deliveries will increase, but we believe the current dynamic could extend the cycle as retirements increase due to older aircraft flying longer as new deliveries are delayed. Jefferies estimates nearly 40% of parked aircraft are over 20 years old which compares to a retirement age of 20-25 years for a typical passenger aircraft.

We see a potential positive scenario for aerospace due to normalizing air traffic demand post-COVID, ramping airline aircraft orders due to travel demand and a desire to modernize fleets, and a parked fleet of aircraft that continues to decrease in size and increase in age. We see opportunity in companies exposed to aftermarket, spare parts, and leasing space in the near-term and companies exposed to new aircraft deliveries in the medium-term as supply chains ease. As a result, we are actively searching for investment opportunities within aerospace subsegments we believe can benefit.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of June 2023 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since June 2023 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team