In an environment characterized by low interest rates, macroeconomic concerns, and a flat yield curve, insurance stocks have been a relatively attractive industry for investors in the financials sector. More specifically, various commercial insurance stocks have reported accelerating rate increases as some of the largest players in the market have been withdrawing from certain lines of business. This bullish narrative about rising premiums was disrupted recently by a few industry participants calling out rising losses necessitating building reserves, more than offsetting the benefit of higher premiums.

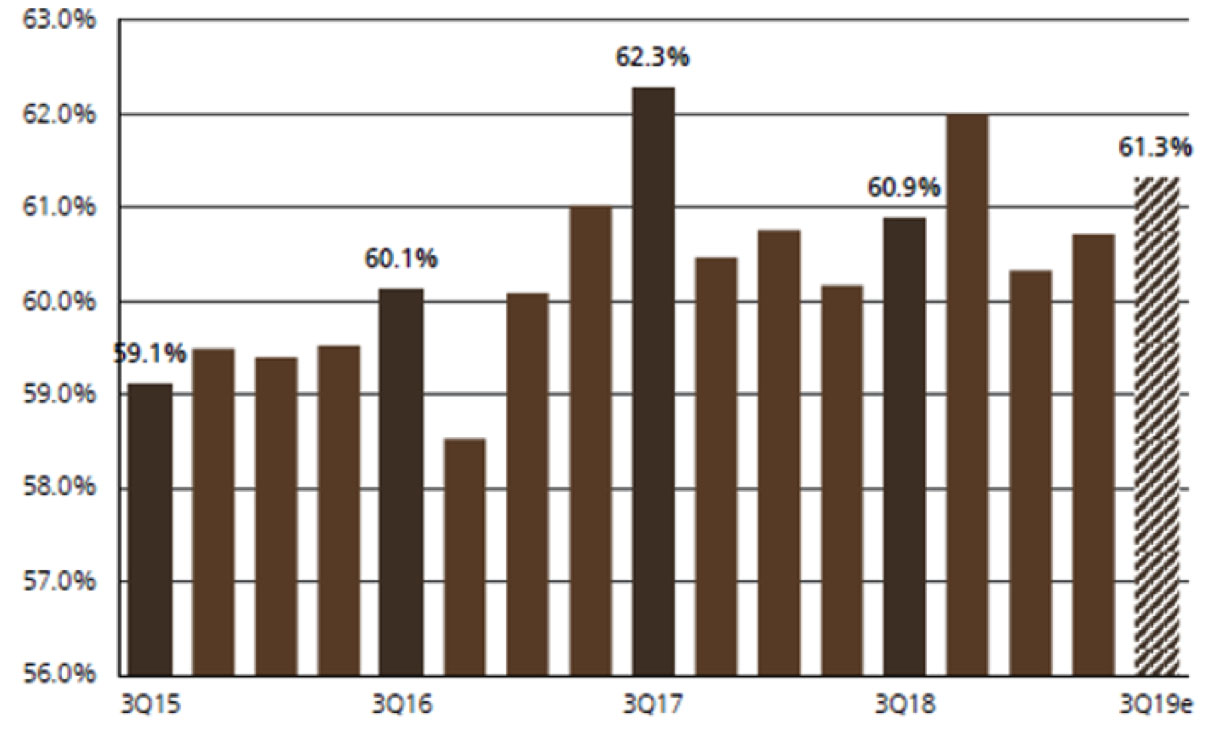

Several causes of rising losses have been called out. Commercial auto insurance has been a particularly problematic line of business for insurers as new ride-sharing business models, without the decades of loss experience of other businesses, have proven harder to reserve for and have become prime targets for personal injury lawyers. Other insurers have noted rising social inflation. Social inflation is an increase in insurance losses driven by higher jury awards, more liberal treatment of claims by workers’ compensation boards, legislated rises in compensation benefit levels, new concepts of tort and negligence, the growing trend of third-party litigation funding, the availability and analysis of attorney data and tactics, changing views of social responsibility coupled with the erosion of trust in corporate America, the increased use of legal advertising, and the rise in populist sentiment.* Some juries see their role in determining damages as increasingly needing to punish corporate malfeasance in addition to compensating the injured. Whatever the cause, frequency and severity are rising and putting upward pressure on loss ratios across the industry (Exhibit 1).

Exhibit 1: Commercial underlying loss ratios have deteriorated y/y and come in worse than original expectations

Source: Company reports, Visible Alpha

One way for investors to participate in the rising premium environment, without taking the risk of rising loss ratios, is with insurance brokers. Insurance brokers are paid as a percentage of premiums placed and therefore benefit as rates increase, but without taking on the underwriting risk that carriers assume.

*“Social Inflation in the U.S.: What Is It and Why Is It a Concern?” PartnerRe Social Inflation in the US What Is It and Why Is It a Concern Comments, 26 Nov. 2010, https://partnerre.com/opinions_research/social-inflation-in-the-u-s-what-is-it-and-why-is-it-a-concern/; “Five Thoughts on Social Inflation.” Five Thoughts on Social Inflation | Captive.com, 30 Oct. 2019, www.captive.com/news/2019/10/30/five-thoughts-on-social-inflation.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of November 2019 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since November 2019 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team