The trucking industry in the United States is broken down into two primary segments, truckload (TL) and less-than-truckload (LTL). Less-than-truckload is used when freight does not require the use of the entire trailer and is often a blend of shipments from multiple shippers on a more regional basis. Truckload is used when freight occupies most of the trailer, typically consisting of freight from a single shipper, and often has a longer length-of-haul. The LTL industry is perceived to have a higher moat, as it is more consolidated with the top 10 players controlling 70%+ of the market and having higher capital requirements to secure terminal locations. A shortage of prime real estate locations in LTL is a barrier for both incumbents expanding their footprint and new competition attempting to enter the market.

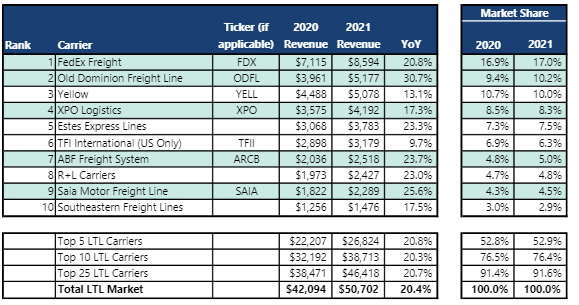

In August of 2023, the LTL industry experienced a structural shock when Yellow Corporation filed for bankruptcy. As shown in Exhibit 1, Yellow Corporation was the third largest carrier with an 10.0% market share in 2021. Yellow’s exit created a volume tailwind for the rest of the LTL players as there was a scramble for customers to secure replacement capacity. While it’s never good to see bankruptcy, Yellow’s exit potentially occurs at an opportune time for the industry, as a weak freight market had driven volumes down year-to-date, and many players had excess capacity. Investor perception seems to be that this freight will flow to “more disciplined” operators, improving overall industry fundamentals.

Exhibit 1: LTL Market Share

Source: Jefferies, as of 12/31/21

Going forward we are optimistic about the outlook for public LTL players. Before the end of 2023, the auction process for Yellow’s terminals should be completed, providing an opportunity for many players to increase network density through purchases of these terminals. Even if companies don’t secure new terminals through the auction process, secondary sales as a product of the initial auction will provide additional opportunities.

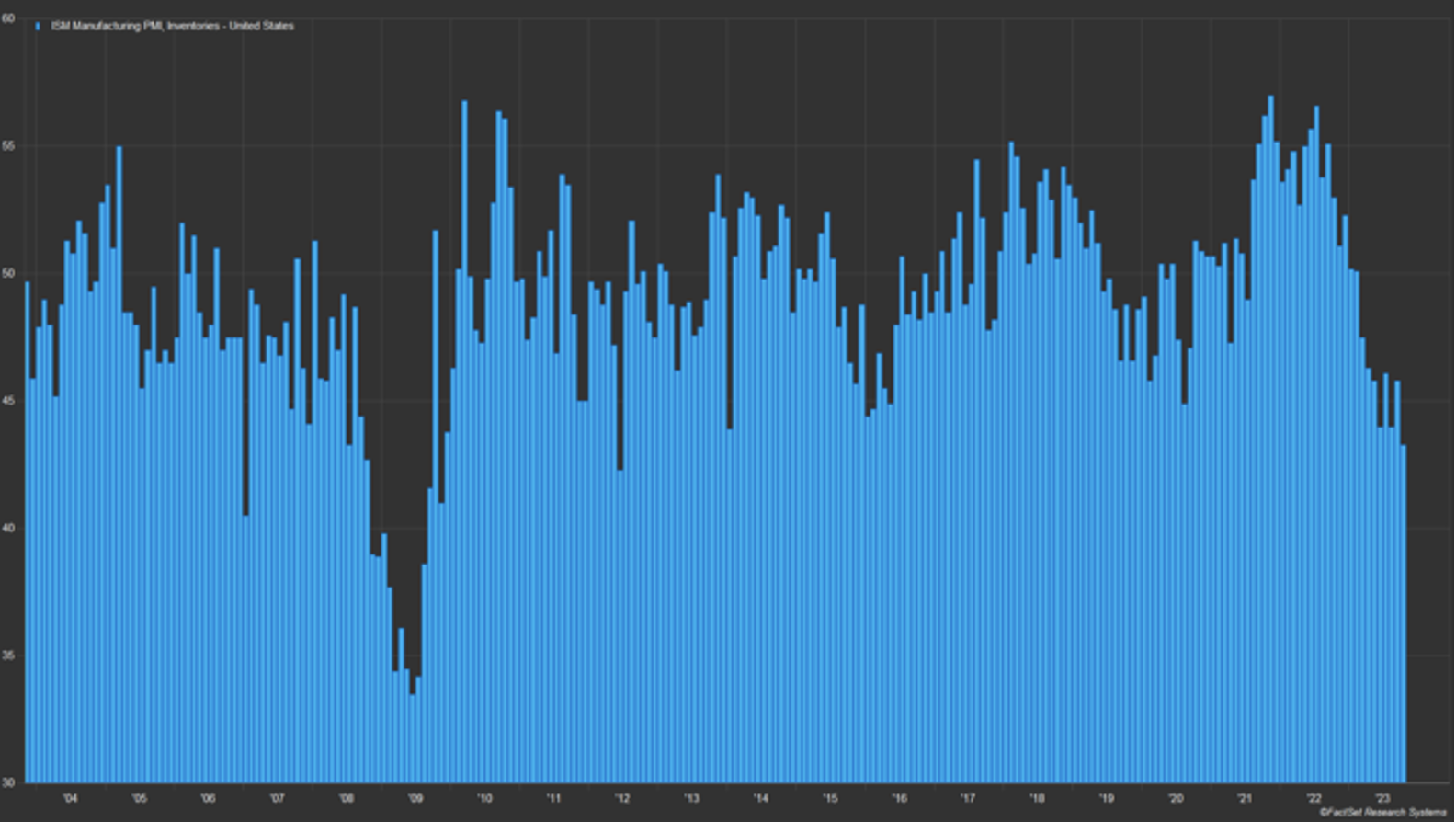

Freight volumes remain weak, but we believe this share gain opportunity can provide a buffer. While we don’t know where the bottom will be, there is one positive sign. Inventory destocking, as measured by the ISM manufacturing index component shown in Exhibit 2, is nearing trough levels. Once inventories stabilize, the LTL industry is positioned to benefit as a large mix of revenues come from industrial customers. Long-term, re-shoring should drive a demand tailwind for what is likely a more consolidated and disciplined LTL industry.

Exhibit 2: ISM Manufacturing Index Inventory Component

Source: FactSet Research Systems

We see potential investment opportunities in companies within the LTL industry and continue to look for opportunities for our investment strategies.

Reasons we are bullish on the LTL market in 2024:

- A once-in-a-generation share gain opportunity for LTL operators with Yellow Corporation out of the industry. In many cases, this share will flow to operators perceived to be more disciplined.

- Industry terminal capacity will likely decrease as a large portion of Yellow’s real estate is thought to be in highly desirable areas and attractive to investors from outside the trucking industry.

- After initial terminal sales from Yellow are closed in the auction, there is likely to be a knock-on effect, as bid winners divest secondary locations they have in those markets. This will enable multiple players to add these newly divested locations and improve density in their networks.

- The inventory component of the ISM Manufacturing Index was at 43.30 in October 2023 which is near trough levels seen in prior cycles (outside of 2008-2009). This increases our conviction that industrial destocking is near completion and could become a tailwind in 2024.

- Re-shoring of manufacturing in the United States is a LTL secular trend. As industrial customers expand current and open new manufacturing lines, it can drive incremental LTL demand.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of November 2023 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since November 2023 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team