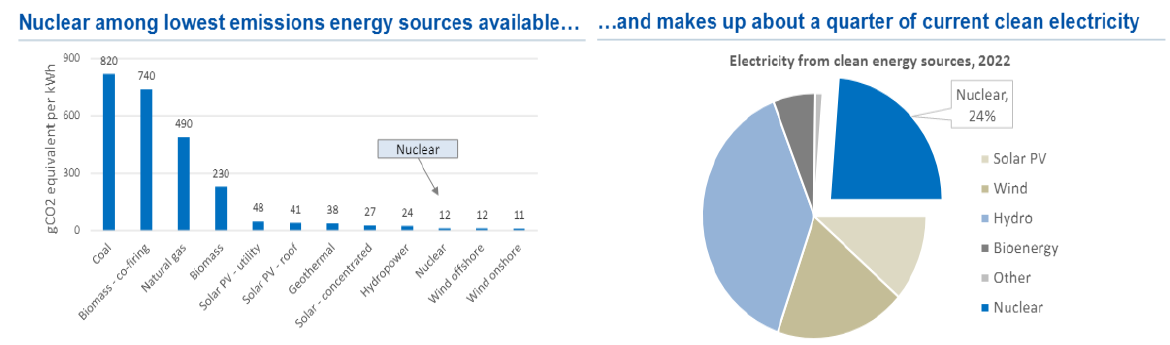

We initially covered the uranium market in a piece called Nuclear Revival in November 2021 that outlined the upcoming inflection in uranium demand. As we sit here today in early January 2024, we can say that inflection has come to pass. Nuclear power has been embraced globally as a critical source of energy due to being a reliable, low-emission source of energy. See Exhibit 1.

Exhibit 1: Nuclear Emissions Compared to Other Sources

Source: RBC Capital Markets

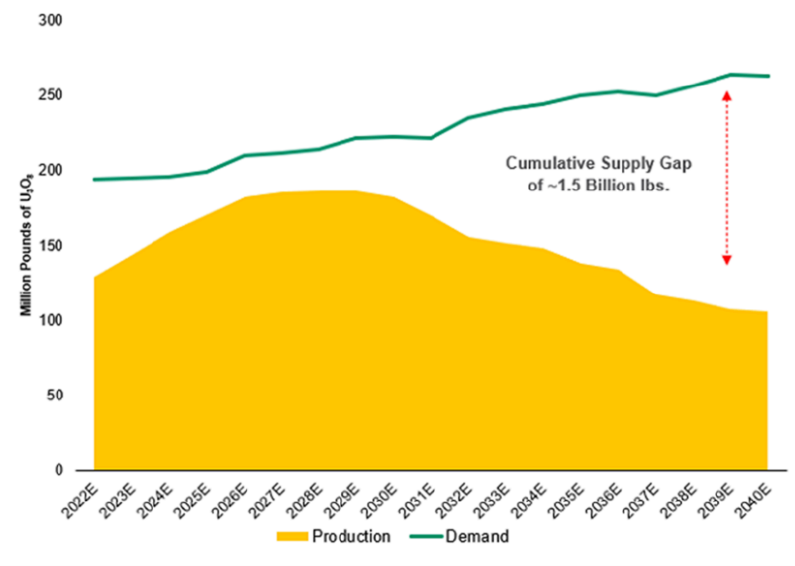

At the recent World Climate Action Summit-COP 28 more than 20 countries across four continents declared ambitions to triple nuclear energy capacity by 2050. By our estimate, this would take current global nuclear power generation from 392 GW to over 1 TW, translating to an incremental 12.5 million pounds of uranium demand per year on average through 2050. According to the World Nuclear Association, there are currently 437 operable reactors, 61 under construction, 113 planned, and 328 reactors proposed. The pipeline is simply robust. We believe the goal is overly ambitious because it will be challenging to execute. Nonetheless, it makes nuclear power a growth industry once again. The uranium demand in 2023 was just under 200 million pounds compared to the production of about 145 million pounds implying a market deficit of ~50-60m pounds. See Exhibit 2.

Exhibit 2: Uranium Supply and Demand

Source: Uranium Insider, UxC LLC, Data Estimates as of Q2 2023, World Nuclear Association as of 8/1/2023

As we mentioned in our prior update, the price of uranium needs to go higher to incentivize new production. However, this is easier said than done. In 2023 and already in early 2024, the two largest uranium miners in the world, representing about 50% of market production, have announced production shortfalls due to inefficiencies brought on by restarting idled mines, labor shortages, and material shortages. These challenges are somewhat structural when you consider more than half of the US mining workforce, 221,000 workers, are expected to retire by 2029, per Uranium Insider. We think this brings into question the market’s ability to adequately respond to increasing demand for uranium. The widening supply and demand gap is going to translate into much higher uranium prices in the future as the deficit persists. At the time of writing this note, the spot price of uranium breached $100 per pound compared to $35 in 2021. Uranium prices are behaving as expected.

Exhibit 3: Uranium Spot Price

Source: UxC, LLC, Bank of America Global Research

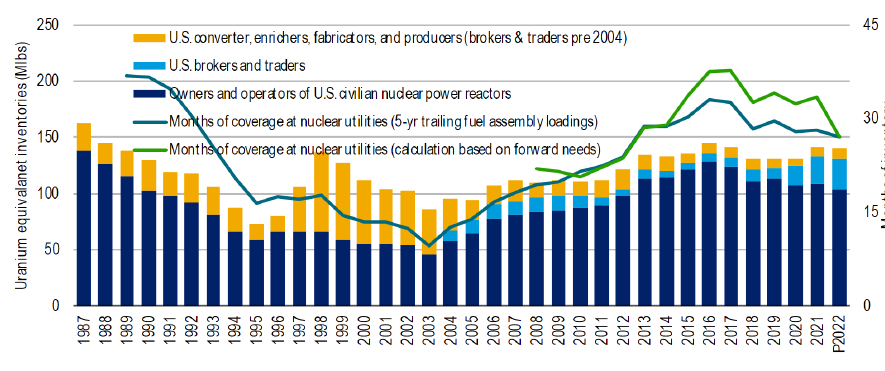

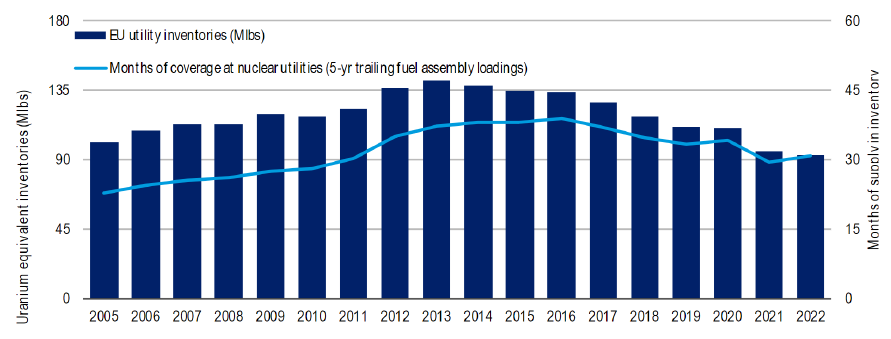

Utilities prefer to buy uranium through contracts with producers, and we are at the beginning of a new contracting cycle. In 2023, utilities represented 25% of spot volumes compared to 13% in 2022, per Bank of America. They are short uranium. Not until 2023 have utilities contracted enough volume to equal replacement/consumption rates. Uranium is contracted years in advance, so these contracts are not for near term delivery. Utilities have been drawing down inventories due to what had been an oversupplied market for decades. US utilities seem to be in a better inventory position than their peers in Europe, but both groups have been destocking. Historically, uranium was plentiful, so securing supply was never a concern, until now. Exhibits 4 and 5 demonstrate decreasing inventory positions at a time when demand is accelerating.

Exhibit 4: Utility Inventory: US

Source: Bank of America Global Research, US Energy Information Administration, Uranium Marketing Annual Report

Exhibit 5: Utility Inventory: Europe

Source: Bank of American Global Research, Euratom Supply Agency Annual Reports1

As production inevitably increases, uranium mining companies will be able to contract at higher prices, which will drive robust earnings and free cash flow (FCF) growth as pounds come out of the ground. Producers who have already contracted portions of their available production above their all-in sustaining costs are undoubtedly poised to realize strong earnings and FCF growth, but they will miss out on some of the upside compared to developers that have left their order books open. At $100 spot, we expect more miners with uncontracted uranium to begin locking in market-based contracts as utilities’ supply concerns mount. The gates to ramping production are opening, but producers, developers, and explorers will likely face production challenges ahead.

1 Note: Includes all EU-27 states and the U.K. Countries with nuclear reactors as of year-end 2020 are Belgium, Bulgaria, Czechia. Germany, Spain, France, Hungary, Netherlands, Romania, Slovakia, Finland, Sweden and the United Kingdom.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of January 2024 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since January 2024 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team